Programmable Settlement for Global Trade

Define rules, connect events, earn yield while funds wait, and let settlement execute automatically when conditions are met.

Be first to pilot programmable settlement.

What Mentriva Does

Global trade still relies on trust assumptions, slow manual settlement, and heavy operational friction.

The Problem:

- Delays and operational risk from manual processes

- Large amounts of idle capital sitting in accounts "just in case"

- Counterparty uncertainty and settlement lag

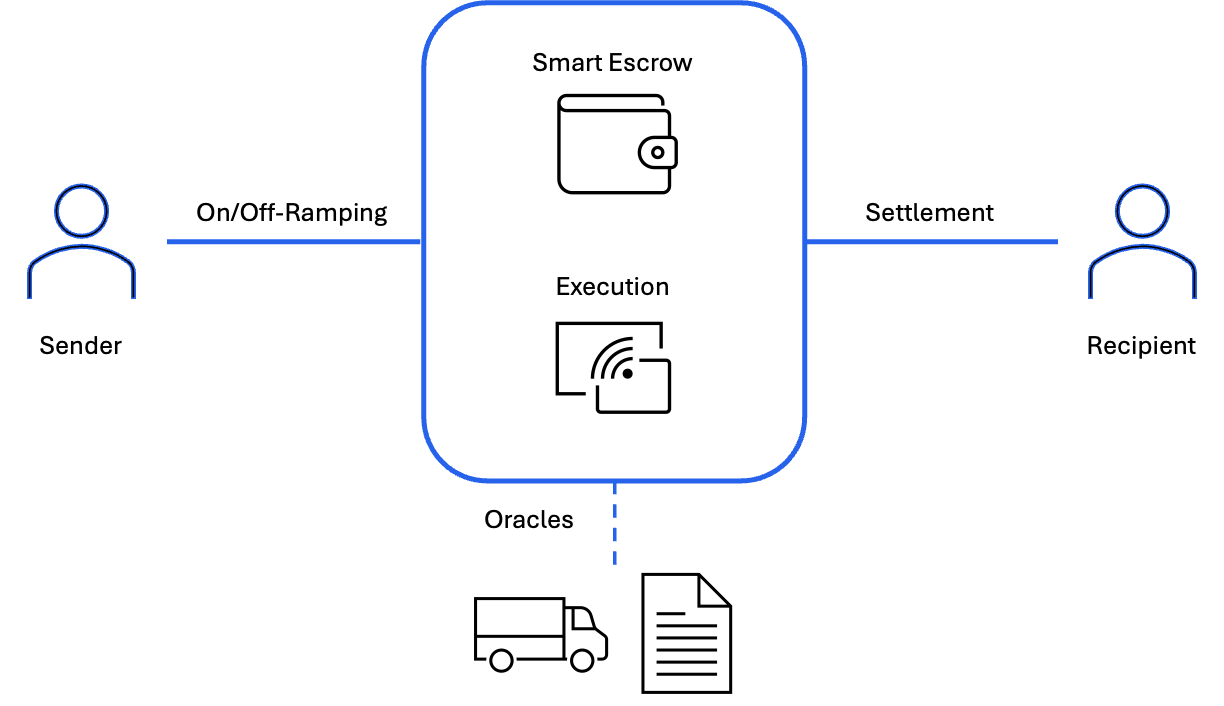

Mentriva is the programmable settlement layer for these flows. You define when funds should move, which events unlock them, which oracles to trust, and how idle balances are managed in the meantime.

The Result:

- Less friction in settlement flows

- Reduced operational risk

- Capital that actually works while trades are being processed

How It Works

Step 1

Define your settlement logic

Specify conditions, approvals, counterparties, currencies, and any guardrails around when funds may or may not move.

Step 2

Connect oracles and events

Choose the signals that matter to you: inspections, logistics milestones, eBL updates, signatures, bank confirmations, attestations, or API data.

Step 3

Execute settlement automatically

When the conditions are met, stablecoins move instantly according to the rules you defined — fully traceable and compliant.

The Opportunity Everyone's Missing

Keep funds productive while trades are pending.

A rules engine that translates business logic into deterministic settlement behavior.

Every settlement is traceable and meets regulatory requirements.

Execute settlement instantly with no delays or dependency on third-party operating hours.

Who It's For

For traders, wholesalers, and equipment suppliers who ship first and get paid later. Lock buyer funds up-front and trigger automatic payout on delivery — removing settlement lag and counterparty uncertainty.

For luxury resellers, premium exporters, and art dealers where trust and authenticity matter. Protect both sides with verifiable funds, secure shipment, and automatic release.

For hardware suppliers, crypto-infrastructure vendors, and digital marketplaces. Enable secure, condition-based payment without holding customer funds or relying on trust.

Be First to Pilot Programmable Settlement.

Request early access and we'll reach out about early access pilots.

Limited spots available for early adopters